Volume 5, No. 2, Art. 24 – May 2004

The Yin and Yang of U.S. Image: Using Focus Groups to Understand Anti-U.S. Attitudes in Italy Experience1)

Janice Bell

Abstract: Quantitative surveys conducted over the past decades have shown that west Europeans, and Italians in particular, tend to hold generally favorable attitudes toward the United States. Even casual observation of the domestic media, however, reveals equally consistent critical attitudes toward the U.S. Especially now that public debate over the future of the transatlantic alliance has become more pronounced, it has become necessary to look under the surface and investigate Europeans' attitudes toward the U.S. This paper presents one piece of a larger project: in April 2002, focus groups were conducted among Italian adults selected for their negative opinions of the U.S. This paper discusses the design of these focus groups, how they were carried out, and some key findings. It argues for the usefulness of this less-common use of focus groups, to give depth and perspective to long-established quantitative trends.

Key words: focus groups, Italy, U.S. Image

Table of Contents

1. Introduction

2. Context

3. Defining the Groups and Recruiting Participants

4. The Discussion Guide

5. U.S.: Imperfect But Essential Partner

6. Conclusion: Top Tips for Focus Groups on International Issues

6.1 Do your homework

6.2 Screen your participants

6.3 They will forget about the video camera

6.4 You can keep your confidentiality, especially if research is ongoing

6.5 Let them catch their breath

6.6 A full transcript can be useful

6.7 Communicate with your project coordinator

For the past fifty years, the Office of Research has been tracking global public opinion on a range of subjects of importance to United States policy makers, including trade, democracy, security, and attitudes toward the U.S. The Office of Research analysts are insulated from the policy making process, and are tasked with monitoring the actual, unvarnished state of public opinion abroad. As part of this work, the Office of Research hires local, in-country contractors to carry out fieldwork. Firms are selected for the ability to meet the highest professional standards for methodologically rigorous and objective survey research. [1]

Quantitative surveys have traditionally accounted for the majority of projects conducted by the Office of Research. Because of the number of trend questions tracked year after year and the institutional knowledge of its staff, focus groups are not systematically used as part of questionnaire development. This is in contrast to some of the "textbook" applications of qualitative survey. Instead, qualitative research is typically undertaken to give meaning and expression to established trends, where direct questions are often used to capture nuanced and complicated attitudes. [2]

This paper describes one such application of qualitative research to provide context to established quantitative trends. My comments are written from the perspective of an analyst and a client of polling firms. It should also be noted very clearly that all comments and analyses in this paper are my own, and do not represent the views of either the United States government or the Department of State. In addition to explaining the purposes of this study and presenting some of its findings, I will also present some "lessons learned" that may be useful for others, working in many fields, who contract and analyze the results of such studies but are one step removed from the actual fieldwork. [3]

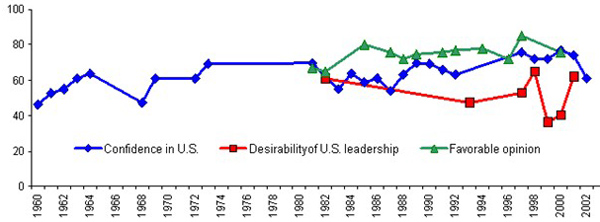

Nationally representative surveys of the Italian public over the past decade have shown a fairly consistent pattern toward the United States. One of the longest-running measures is confidence in the U.S. as a global actor2). This measure tends to be somewhat volatile and reactive to recent events, and desirability of U.S. global leadership3) appears even more sensitive. For instance, in 1999, there was a reaction against U.S. leadership due to the Cavalese incident, when a U.S. fighter jet caused a ski gondola to crash, killing 20 people. Yet with time, opinion recovered to levels seen before this incident. [4]

The third measure in this figure is favorability toward the U.S.4). Publics tend to show more favorability toward the U.S. than confidence in the U.S. on more policy-related indicators, and favorability tends to be more stable and immune to events than other indicators. This overall stability makes the decline observed since 2000 all the more interesting. The graph only extends to spring 2002, contemporaneous with the focus groups examined in this paper. While it does not record public opinion during the Iraq action, it does show that Italian opinion toward the U.S. had only a modest bump upward after September 11, particularly in the desirability of U.S. leadership variable. Confidence and favorability showed some weakening, but overall remained near the long term trend.

Figure 1: Italians' opinion of the U.S. [5]

Over the years, then, we had gained a fairly clear perspective of the generally positive views Italians hold of the U.S., and the recognition of the presence of a substantial anti-U.S. minority. In particular, critical views of the U.S. are more prevalent among those who support left-leaning political parties; the older generation tends to be more positive toward the U.S. than young adults. [6]

Through additional questions, we learned other factors that appeared to contribute to these sentiments. On the economic front, Italians favor free trade, but see the U.S. as practicing trade protection. On a range of issues including trade disputes, encouraging democracy in Cuba and protesting the global environment, Italians see U.S. policies to be in conflict with their own country's policies. While Italians say the U.S. does a good job at providing economic opportunity, protecting religious freedom and maintaining law and order in their own society, the U.S. is seen to have a more mixed record on providing health care to all, assuring minority rights, and protecting the economically vulnerable. [7]

While this depth of knowledge was achieved through quantitative work, we felt that we did not have a complete grasp of the relative importance and the possible interaction between these various criticisms in how people weighed their views of the U.S. Therefore we decided to conduct a series of focus groups among European critics of the United States. We wanted to try to capture the range, depth and intensity of anti-U.S. sentiment, the lines of reasoning they employed, and the words they used to describe their feelings. To this end, the data and analysis in this paper will be restricted to the period up to and including the focus group fieldwork. [8]

3. Defining the Groups and Recruiting Participants

The firm Pragma in Rome was contracted to conduct the focus groups, and I worked closely with Pragma on each of the steps outlined below. The first step was to define the target population and draft the questionnaire we would use to screen potential participants. [9]

As described above, past quantitative research has shown a number of robust and durable factors behind Italian public attitudes toward the United States. Defining the target population for the groups was based on our analysis of quantitative data, including the importance of demographic factors. The focus groups were held in Rome, and recruitment was designed to attract participants from as wide a possible as range of neighborhoods and areas. In contrast to some recruitment procedures, where participants are drawn from the recruiter's database, we asked Pragma to recruit participants just as they would select respondents in Rome for a typical nationally representative, stratified random sample. While this was a more expensive and time-intensive method, it was both consistent with practices used in other countries included in this project and it also ensured that we would get people new to the experience of focus groups. [10]

In the field, the recruiters selected participants for the following characteristics via a screening questionnaire:

Not having participated in focus groups in the previous six months;

being between the ages of 25 and 65;

having at least a complete secondary education;

saying they frequently discuss political issues;

reading a newspaper several times each week;

having an interest in international issues;

saying strong U.S. global leadership is undesirable for Italy's interests, the same question as mentioned above (see Note 4);

supporting a leftist political party, include of center to far-left. [11]

The political filter was in line with Pragma's usual practice to select groups to be politically homogeneous (left or right) in order to ease discussion on controversial topics. Four groups were scheduled, two with left-leaning voters and two with supporters of right-leaning parties, with each orientation having one group with participants aged 25 to 45 and a second with participants aged 46-65. Participants were also recruited in order to achieve an equal number of men and women in each group, and a balance of professions and incomes. Since there is always the likelihood that people who agree to come to the groups will be unable or decide not to do so, we asked for ten participants to be recruited for groups of eight. Those who turned up but were not needed were given the same incentive as participants. [12]

Pragma provided an experienced moderator and a simultaneous translator. In both cases, it was invaluable to have skilled people with expertise on international and political topics. A colleague and I observed the groups, and we also requested video tapes and audio tapes of the simultaneous translation. Of course, the tapes are only used for internal purposes. After the groups, verbatim transcripts in Italian were delivered, along with a direct and complete English translation of the verbatims. While firms may offer a transcription of the simultaneous translation, having the verbatims translated provides a much more complete record of the discussion. This is especially true if the discussion heats up—even the best simultaneous translation may be unable to keep up, whereas the transcriber can listen repeatedly to get more of the group's thoughts into print. [13]

The groups were scheduled for April 17-19, 2002 and held in Pragma's facilities in central Rome. Sufficient numbers of participants arrived and we had three groups of eight and one group of nine participants.5) Two groups had more women than men (5:3), one had more men (5:4 women), and one was evenly balanced. The gender mix was successful and seemed to contribute to the quality of the discussion. Of the 33 participants, most (27%) were employed, with a number of clerical workers (9), professionals and managers (7) and teachers (5), While they got their news from a variety of outlets, La Reppublica, Corriere della Sera and the Internet were among the most often cited sources. [14]

For this study, one standard discussion guide was developed for use in a number of European countries. Designed for two-hour sessions, after introductions and an overview of the purpose of the groups, the discussion was organized into four sections:

Introduction: Issues of concern in Italy, Europe, the world today (10-15 minutes);

multilateralism: In trying to solve these problems, should Italy cooperate with other countries and international organizations (15-20 minutes);

image of countries: Italy's role in European/world affairs, image of France/Britain/Germany/United States—partners or rivals to Italy (25 minutes);

United States: Its role in world affairs (economic, foreign policy, security), relations with and benefits/costs for Italy, what they liked about the U.S., why do some hold unfavorable views; values and lifestyle of average Italian/American; where do you get information about the U.S. (45 minutes);

closure and self-administered follow-up questionnaire: anything not covered. [15]

Like the screener, the discussion guide and follow-up questionnaire were translated into Italian, with the Italian version then translated back into English by Pragma. As a result of conducting the same translation process in a number of countries and languages at the same time, we were able to learn from the translation process to refine and streamline the discussion guide further. The Pragma staff went through the discussion guide with us before the first group. At the mid-point and after the end of the first focus group, we agreed with the moderator on a number of small adjustments to help the flow of the discussion. In general, the guide was neither too vague nor too detailed. In part this is because we cut a number of detailed keywords and ideas that we originally planned to raise in each of the groups. Instead, we asked the moderator to probe these specific topics if they came up naturally in discussion. A short break was made between sections 3 and 4. The change in topic made it a natural place for a pause. [16]

5. U.S.: Imperfect But Essential Partner

The groups proceeded smoothly, and provided a lively and informed discussion among the participants. In brief, the criticisms that were voiced in the focus groups closely echoed themes that we have heard across Europe, in public and elite surveys, as well as around the globe. Perhaps the most universal criticism was based on the possibility and reality of U.S. unilateralism. Yet regardless of their opinions of the U.S., these Italian participants clearly stated that there are benefits to open and friendly relations with their "indispensable partner." [17]

Some surprising patterns emerged. It was striking how the participants mostly expressed moderate and balanced views of the U.S. Despite selecting people for their anti-U.S views—which were freely expressed—these Italian participants took care to balance their criticism with some alternative views. This style of discussion led to a "yin and yang" model of criticism: a spate of criticism was countered by at least one positive point, leading to a sort of mirror image argument. For instance, the U.S. was described admiringly as "a true frontier"—but also as a society with no roots, no culture, no tradition, and no interest in international affairs. Americans were described as enthusiastic but naïve, pragmatic but individualistic, efficient but lacking sympathy for the poor, straightforward but arrogant. In addition, we were also surprised by the way in which participants—younger and older alike—spontaneously referred to Italy's debt of gratitude to the U.S. for the Marshall Plan. [18]

The information gained from the focus groups was used in a variety of ways, including a multi-country report that synthesized quantitative and qualitative research (see references). Moreover, after having analyzed and written about the focus group findings, analysts in the Office continue to apply the insights and knowledge gained through the groups to questionnaire development and use of quantitative data. The focus groups, then, are not just an exercise in themselves but also a way to deepen the expertise of analysts. [19]

6. Conclusion: Top Tips for Focus Groups on International Issues

After having completed an intensive series of focus groups in 2002, the successful Italian case may serve as an example for some practical conclusions for those commissioning and analyzing focus group discussions. [20]

It goes without saying that you can save a lot of time and effort by studying your own precedents and other researchers' publicly available data on the topic. Quantitative findings can help you to hone your discussion guide, pare down the introductory sections, and then use the focus groups to find out what you don't already know. Careful selection of the contracting firm and meticulous and informed preparation of the screener, discussion guide and any follow-up questionnaires will be rewarded many times over. An important corollary to this point is to streamline your discussion guide. [21]

Especially if you are researching detailed political or international issues, it makes sense to give careful thought to how you will screen and select your participants. Focus groups are not going to be representative, so use the forum creatively. For the anti-U.S. focus groups, screening participants for interest in international relations clearly produced a livelier and better informed discussion. We wanted to target those with clear—and critical—views on the U.S., and we succeeded in this respect. Also, homogenizing the groups by generations and political outlook often helps, although it is usually beneficial to have a balance of men and women in each group, as appropriate to the topic. [22]

6.3 They will forget about the video camera

One concern often expressed when preparing for focus groups is that participants will object to being videotaped. At the start of each group in this study, the moderator fully disclosed that the sessions would be recoded. There were some nervous glances to the discreetly-placed video camera and the one-way mirror at first, but typically within five to ten minutes the participants all but forgot that they were being recorded. [23]

6.4 You can keep your confidentiality, especially if research is ongoing

As one might well imagine, in order to avoid sources of bias, the moderator did not identify the United States Department of State as the organization commissioning these focus groups. On the other hand, the law in many European Union countries requires disclosure of at least some information about who has commissioned the work. We came into the groups concerned that some invitees would refuse to participate if the sponsor was not disclosed. Not wanting to compromise our confidentiality, we instructed Pragma to tell the participants, if asked, that this was part of an international research project, that the results for strictly for research purposes, and that the identity of the participants would be held in strictest confidence. Of course, all these statements are true, and this proved sufficient for the participants. In fact, after the groups, some even said half-joking that they hoped the U.S. government was listening. Moreover, this is one important reason to over-recruit for your sessions. If you schedule ten people to come for a eight-person group, if someone balks at the lack of disclosure, they can be replaced. [24]

6.5 Let them catch their breath

It helps to have a natural place for a break built into the discussion guide. While two hours is not too long for a focus group, a break midway not only lets the observers have a chance to talk to the moderator about the progress of the groups, but is also lets participants take a break, relax and talk amongst themselves without the obvious overview of the moderator. This pause seems to help break down any residual hesitancy or formality within the group. Then, when the group resumes, the participants are usually ready to take on more challenging topics. That said, if the group is on a roll, it can be best to wait until there is a natural break in the discussion. [25]

6.6 A full transcript can be useful

Often firms will offer a full analytical report of the focus group discussions. Many clients will find this useful, and it is a good way to benefit from the first-hand knowledge of the contractors. In my experience, if the information gained from the focus groups is to be used for detailed analysis and questionnaire development, it is also useful to take the (often more expensive) option of requesting both full, verbatim transcripts in the original language and direct translations of the transcript. Because of the pace of the discussion, a simultaneous translation may not capture all the flow and content of the discussion. Also, verbatim transcripts can be used for a side-by-side reading of the Italian and English versions. Not only does it let you do your own analysis of the groups and pull out useful quotes, especially if you observed the sessions, but having the vernacular is helpful for the subsequent development of the language used in questions for quantitative surveys. [26]

6.7 Communicate with your project coordinator

This is perhaps the most important element, and it ensures all the preceding steps happen. [27]

Most importantly, perhaps, the local firm can prove essential in helping you navigate relevant aspects of the local culture. As part of the preparation for the groups, your coordinator should be able to comment on the content of your recruitment screener and composition of the groups, including whether it is appropriate to divide by age, sex, or political orientation. Moreover, the right local moderator will be able to guide discussion effectively and sensitively. [28]

1) All research presented in this paper was conducted by the Europe Branch, Office of Research, United States Department of State. The author would like to thank the Office of Research for allowing the use of these findings. The analysis and views in this paper are the author's own and do not represent the views or the policy of either the United States Government or the United States Department of State. <back>

2) "How much confidence do you have in the ability of the United States to deal responsibly with world problems? Do you have a great deal of confidence, a fair amount of confidence, not very much confidence or no confidence at all?" Quanta fiducia ripone nella capacita' degli Stati Uniti di trattare con responsabilita' i problemi mondiali? ha molta fiducia, abbastanza fiducia, pochissima fiducia o nessuna fiducia?—All data and question wordings cited in this paper are drawn from studies conducted by the Office of Research of the United States Department of State. <back>

3) "For the interests of Italy, how desirable is strong U.S. leadership in world affairs? Is it very desirable, somewhat desirable, somewhat undesirable or very desirable?" "Per gli interessi dell'Italia quanto ritiene desiderabile che gli Stati Uniti esercito una forte guida negli affair mondiali? E' molto desiderabile, abbastanza desiderabile, abbastanza indesiderabile o molto indesiderabile?" <back>

4) "Do you have a very favorable, somewhat favorable, somewhat unfavorable or very unfavorable opinion of the United States?" "La Sua opinione sugli Stati Uniti è molto favorevole, abbastanza favorevole, abbastanza sfavorevole, molto sfavorevole?" <back>

5) In the final group, we had been planning to have eight participants, but the ninth person who showed up wanted to participate, so we let him stay. <back>

Office of Research (1999). The New European Security Architecture: Public Attitudes toward Security on the Eve of NATO's 50th Anniversary (Volume IV). Washington DC: USIA Office of Research and Media Reaction.

Office of Research (2002). Europeans and Anti-Americanism—Fact and Fiction: A Study of Public Attitudes toward the U.S. Washington DC: Office of Research, United States Department of State.

Janice BELL is Director at Ipsos-Public Affairs in Washington, DC. Until recently, she was an analyst in the Europe Branch of the Office of Research at the U.S. Department of State, and has taught at the Universities of Sussex and London in the UK. Her publications include The Political Economy of Poland's Post-Communist Transition (2001, Edward Elgar Publishers) and, co-authored with Tomasz MICKIEWICZ, Transitional Unemployment or Transition To Unemployment? Labour Markets in Central and Eastern Europe (2000, Harwood Academic Publishers).

Contact:

Janice Bell

Director

Ipsos-Public Affairs

1101 Connecticut Ave, NW, Suite 200

Washington, DC 20036, USA

Phone: (202) 463 3622

Fax: (202) 463 3600

E-mail: Janice.Bell@ipsos-na.com

Bell, Janice (2004). The Yin and Yang of U.S. Image: Using Focus Groups to Understand Anti-U.S. Attitudes in Italy [28 paragraphs]. Forum Qualitative Sozialforschung / Forum: Qualitative Social Research, 5(2), Art. 24, http://nbn-resolving.de/urn:nbn:de:0114-fqs0402249.